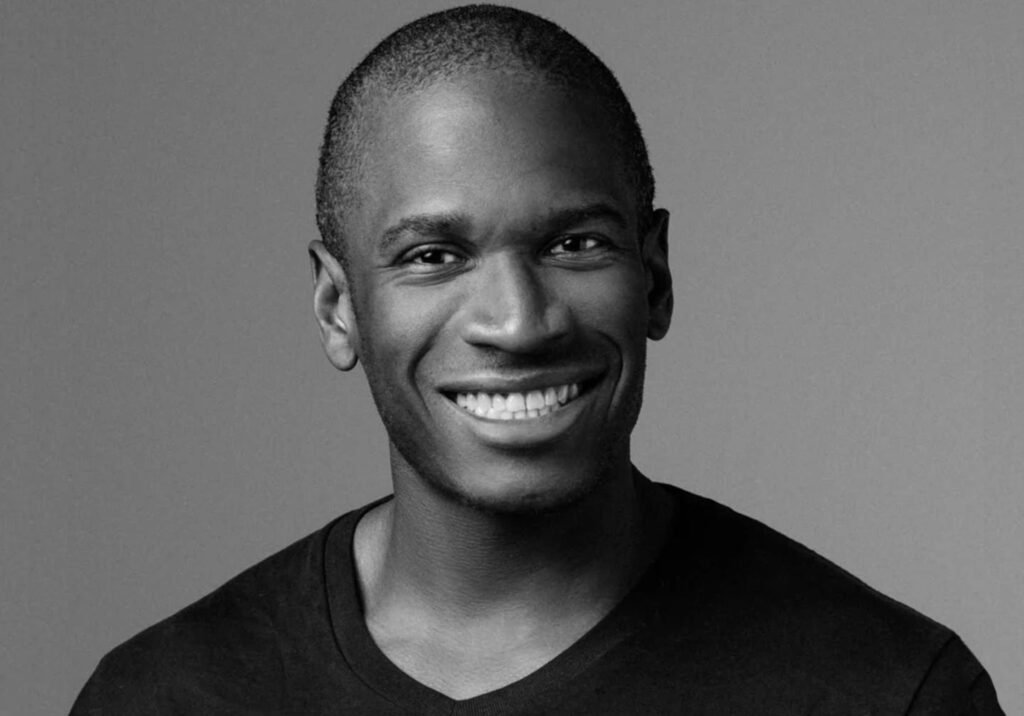

In a bold twist that has captured the crypto world’s attention, Arthur Hayes, the co-founder of BitMEX, sold millions in Ethereum just days ago at around $3,507 per token, only to buy back in at over $4,150 amid a strong market rally. This move comes as Ethereum breaks past $4,000 for the first time since late 2024, sparking debates about market timing, investor confidence, and the volatile nature of crypto trends in 2025.

Hayes’ Dramatic Sell and Buyback Explained

Arthur Hayes made headlines when he offloaded 2,373 ETH tokens for about $8.32 million at an average price of $3,507. That sale happened amid warnings of a potential market dip, with Hayes citing weak US job growth and slowing global credit as reasons for caution.

Just a week later, he reversed course. Hayes poured $10.5 million into Ethereum through several stablecoin transactions, snapping up tokens at prices exceeding $4,150. This buyback not only cost him more but also highlighted the rapid shifts in crypto sentiment. Analysts point out that such actions often signal renewed faith in an asset’s upside, especially during rallies.

Many see this as a classic case of market FOMO, or fear of missing out. Hayes himself poked fun at the situation on social media, joking about his change of heart and vowing never to sell again. This lighthearted take adds a human element to what could be a calculated strategy.

Ethereum’s Price Rally Gains Momentum

Ethereum has been on a tear in 2025, climbing from lows around $2,600 in recent months to surpass $4,000. This surge marks a 45 percent increase over the past 30 days, driven by strong institutional interest and broader market optimism.

Key factors fueling this rally include massive inflows into Ethereum based funds. Data shows over 1.035 million ETH, worth about $4.17 billion, accumulated by large players since mid July at an average price of $3,546. This buying spree aligns with Ethereum’s push toward new highs, making it a standout performer in the altcoin space.

Here are some highlights of Ethereum’s recent performance:

- Peak price in 2025: Over $4,150 as of August 10.

- Monthly gain: Up 45 percent from July lows.

- Institutional accumulation: $4.17 billion in ETH bought by big entities.

- Comparison to Bitcoin: Ethereum outpaces Bitcoin’s 30 percent rise in the same period.

This momentum ties into predictions of a monster altcoin season, where Ethereum leads the charge against rivals like Solana and Cardano.

Experts note that Ethereum’s upgrade to proof of stake continues to boost efficiency, attracting developers and users. However, risks remain, such as potential regulatory hurdles from ongoing US Tariff Bill discussions that could impact liquidity.

Community Buzz and Investor Reactions

The crypto community has lit up with reactions to Hayes’ move. On platforms like X, users express a mix of amusement and skepticism, with some calling it a savvy play and others questioning the timing.

For instance, posts highlight Hayes’ earlier dump of assets like Ethena and Pepe alongside Ethereum, only to reload now. This has fueled discussions on whether high profile investors like him influence market swings or simply ride them.

From a balanced view, supporters argue Hayes’ buyback shows confidence in Ethereum’s long term potential, especially with forecasts of it hitting $5,000 by year end. Critics, however, warn of overhyping, pointing to past corrections where similar rallies fizzled.

| Reaction Type | Key Sentiment | Example Impact |

|---|---|---|

| Positive | Bullish on ETH rally | Boosts trading volume by 20 percent in 24 hours |

| Skeptical | Questions timing | Sparks debates on social media, increasing engagement |

| Neutral | Sees it as opportunistic | Encourages cautious investing strategies |

These varied perspectives underline the emotional rollercoaster of crypto investing, where one person’s buyback can ripple through the market.

Broader Implications for Crypto Markets in 2025

Hayes’ actions fit into a larger picture of 2025’s crypto landscape. Bitcoin recently eyed $100,000 amid tariff talks and economic data, while altcoins like Ethereum benefit from ecosystem growth in layer 2 solutions.

Logical reasoning suggests that with US job reports showing only 73,000 new positions in July, markets could face headwinds. Yet, Ethereum’s rally defies this, supported by tech advancements and capital flows.

Compare this to recent events: Just last month, predictions of Ethereum dropping to $3,000 circulated, but institutional buys flipped the script. This mirrors 2021’s bull run, where similar buybacks preceded major gains.

Investors should watch for signs like increased exchange inflows or macroeconomic shifts. If Ethereum holds above $4,000, it could signal sustained growth, but a drop below $3,800 might trigger profit taking.

What Investors Can Learn and Do Next

This episode teaches key lessons in market timing and resilience. Hayes’ buyback at a higher price reminds us that even experts adjust strategies based on new data, emphasizing research over impulse.

For practical value, consider diversifying into Ethereum focused assets while monitoring global indicators. Tools like price charts and on chain analytics can help spot trends early.

What do you think of Hayes’ move? Share your thoughts in the comments below and spread this article to fellow crypto enthusiasts for more lively discussions.